Wednesday, December 9, 2009

Mediatory Services in Forex Currency Trading

Forex is a non-stock exchange market that has no physical place. Forex is a banking network consisting of companies, forex brokers, private investors, integrated by one organization of information exchange.

As the Forex exchange trading does not rely on physical place, they trade internationally, all around the clock, with the exception of weekends for the time zone of the country dealing with it.

Foreign exchange covers up markets of most nations with universal platforms for foreign currency exchange trading functions in London, Tokyo and New York.

Major groups of Forex currency trading are:

Insurers – The major group is exporting and importing companies and some of the companies which consist of the few functions in foreign currency. For these partakers in forex, the main objective is to ensure loss minimization in a way keeping away from risks.

Speculators – Personal traders and corporations who are intended to trade foreign currency making profit from foreign currency exchange rates and short-term functions go to this category.

Arbiters – Investors of online forex trading who trade with big amounts of cash to invest and function on two or more markets at the similar time and generally they tend to make profit on the basis of foreign exchange rates.

Forex broker – These are brokers, banking establishments, currency dealers and companies who provide with electronic access to trading platforms and giving mediatory services in currency exchange deals.

Dubai crisis rings bells of prudent investment

Unsurprisingly, news of the financial collapse of the emirate's key construction firms came as a shock to many, but as far as regional economists were concerned, the Dubai bubble had been ready to burst for some time.

It is an experience that no country wants to see repeated within its borders. Israeli economists stressed over the weekend that lessons must be learned from the crisis, among which are modesty and caution.

SYMPTOMS

The prevailing view in Israel is that Dubai was simply putting all of its eggs in one basket. Its failure to diversify meant that a meltdown was likely to occur at one point or another.

Diversification of an economy is so important," said Yishay Yafeh, an expert in financial systems at the Hebrew University of Jerusalem.

"You can't base an entire economy on one sector," said Dan Catarivas, director of international relations at the Federation of Israeli Economic Organizations.

Dubai had a bold vision. It took a pearl-fishing village on the edge of the Arabian Desert and transformed it within a matter of a lifetime. Israeli economists told Xinhua they believe that while the dream of Dubai's founder was ambitious and praiseworthy, it was converted over the years by his successors to something that became unsustainable.

Massive investments in real estate led to an overheated economy, and despite government involvement in all the major development companies.

The economy also lacked an export base. In 2006, Dubai's imports totalled some 60 billion U.S. dollars, while exports stood at 5 billion dollars.

"The lesson is that they went too far. It's as simple as that," said Arie Melnik, a professor of economics at the University of Haifa, adding that he believes the "hubris" of the Dubai leaders was at the center of the crisis.

PREVENTION

Catarivas said Israel has got the mix just about right, which is why the country survived the international financial crisis better than most.

Noting that Israel, like Dubai, has virtually no raw materials, local experts said Israel's success is based on human capital.

Meanwhile, they said that Dubai's decision to move the economy in the direction of luxury villas lacked forethought and long-term feasibility.

In Israel, the high-tech industry may be a major force in the economy, recognized as a world leader, but it is not the only basket. Medical supplies, diamond polishing, agriculture and water technologies all rank high.

In Dubai, it was a very different case. "They thought they could do all this even if they couldn't see money at the end of the tunnel. Every small-time builder knows there is one simple rule, you don't begin building if you don't have buyers," said Melnik.

An economy must be diversified, it should be transparent, and a country's leaders should not plan too ambitiously and thus can avoid overextension, said the leading Israeli economists who spoke to Xinhua over the last few days, among other suggestions they offered to ensure no repeat of the Dubai crisis.

"It's about modesty and caution. There, the bubble was behavioral," suggested Moshe Justman, a professor of economics at Ben-Gurion University of the Negev in southern Israel.

FOREVER BURSTING BUBBLES

The Israeli analysts are of the opinion that the Dubai crash will have limited impact on the global stage. However, they cautioned that other crises may be around the corner.

The trouble is how to predict them. "I wanted to call this a million-dollar question, but of course it's worth much more," said Yafeh.

One needs to examine a state's investment portfolio to check whether it is diversified. Then there are the sums involved, said Justman.

There have been bubbles throughout recorded human history, said Yafeh, noting that similar hard times have been occurring for centuries, including the dotcom bubble in recent years.

However, nations tend to survive these difficult moments. The United States may have taken a beating over the last 18 months with the sub-prime crash, but its economy is resilient and large enough to have survived.

Israel and Australia may have growing bubbles right now, but their central banks are playing the game right by adjusting their lending rates accordingly, said Melnik.

At the end of the day, people will view Dubai's financial crisis as nothing more than "a curiosity," according to Yoram Landskroner, an expert on international debt at the Hebrew University of Jerusalem. "Dubai has nothing that links it to any group of nations. It's neither a developed state nor an emerging market."

As a result, little can be applied to other countries from the Dubai experience, other than to say that sometimes caution is the better part of valor.

However, in consideration of previous financial crises in emerging economies, it is safe to predict that some potential investors will no longer put their cash in high-risk, low-rated markets and will return to the days when making a small prudent profit was regarded as far more sensible than a rash gamble on a chancy but exotic option.

Non-bank Foreign Exchange Companies

It is estimated that in the UK, 14% of currency transfers/payments are made via Foreign Exchange Companies. These companies' selling point is usually that they will offer better exchange rates or cheaper payments than the customer's bank. These companies differ from Money Transfer/Remittance Companies in that they generally offer higher-value services.

Types of financial markets

Capital markets which consist of:

Stock markets, which provide financing through the issuance of shares or common stock, and enable the subsequent trading thereof.

Bond markets, which provide financing through the issuance of bonds, and enable the subsequent trading thereof.

Commodity markets, which facilitate the trading of commodities.

Money markets, which provide short term debt financing and investment.

Derivatives markets, which provide instruments for the management of financial risk.

Futures markets, which provide standardized forward contracts for trading products at some future date; see also forward market.

Insurance markets, which facilitate the redistribution of various risks.

Foreign exchange markets, which facilitate the trading of foreign exchange.

The capital markets consist of primary markets and secondary markets. Newly formed (issued) securities are bought or sold in primary markets. Secondary markets allow investors to sell securities that they hold or buy existing securities.

Trend Analysis

The world of investment is flooded with excellent ideas of growing your money, but you are required to make use of geometrical patterns, diagrams, statistical analysis and other similar tools to reach a definite conclusion for efficient investments. The hugest trading market called forex is also not spared from in-depth study of market trends to earn profits and avert losses. Forex trend lines serve the purpose, as these patterns help to extract most rewarding information and plan your course of action for investing in various currencies.

Usefulness of Forex Trend Lines

The forex trend lines are helpful in introducing the most vital entity required by an investor and this entity is called information. How can one expect to make worthy investment, without adjudging the highs and lows existing in the market? Here is the list of most prominent benefits of forex trend lines:

- These lines help to depict the support and resistance levels, which are of great importance in deciding the sale or purchase of various investments.

- The trend lines help the investors to decide their entry and exit points to the forex trading market.

- These patterns make you familiar about nature of forex market; the sharp turns taken by trends and unwarned movements of different investments.

- In a nutshell, these lines fuel technical analysis of this investment market, which is certainly the most appreciable tool for making an investment.

Important Types of Forex Trend Lines

The forex trend lines are available in different popular forms, as summarized below:

- Simple trend lines consist of straight lines drawn vertically, horizontally as well as diagonally.

- Fibonacci trend lines have gained popularity in recent times and are excellent tools of understanding current market trends in forex trading. There are different variations of these lines in the form of Fibonacci Arc, Fibonacci Fan and Fibonacci Retracement.

- Pivot trend lines are drawn on the basis of fluctuations in the market during previous time frames.

- Speed trend lines are similar to Fibonacci trend lines, with the only replacement of Fibonacci numbers with calculations by thirds.

Drawing and Studying Forex Trend Lines

As you grow old in terms of experience of dealing with forex trading, you are able to play with forex trend lines. But, at the very onset of your investments in the forex market, you are required to seek the guidance of forex market experts in drawing as well as interpreting information from the trend lines. For instance, you must be capable of identifying the situation in advance, if the forex market is expected to move in an opposite direction. It could be a sudden turn and you must catch the signals generated by forex trend lines for this behavior of the market. Thus, initial understanding of these trend lines can provide benefit to an investor for rest of his age of investment.

It is the simplest and most convenient in all the technical analysis to draw a trend line on the forex chart. Upward trend:

Downward trend:

Sideways trend:

The market trend is consisted of three stages:

The first is the initial stage where the market trend is shaped up.

The second one is the developing stage where the trend is strongly kept as it is.

The last one is final stage where the forex market begins to suggest the next new trend on a certain turning point.

You can find the clear trend nearing to the final stage as long as you make use of the moving average, because it is coming later than the market movement. It might be fear that you would buy at the highest or sell at the lowest if you missed capturing the market trend accurately.

Forex Trend Lines Tools

There are many online websites, dedicated to introduce automated tools for drawing forex trend lines. These tools are part of automated software systems, available in large quantity over internet. You must evaluate all these systems on the basis of various factors and finally take a decision of choosing one of these tools. Make sure that you choose a reputed resource for accessing these tools.

For becoming a good player of the game of forex trading, you must consider trend patterns as right game gears. Also, keep your knowledge updated about various methods of drawing forex trend lines and switch over to a new system, if you find it more suitable. At a later stage, you will definitely experience the building up of your knowledgebase for forex trading trends and trend lines.

Central banks

The mere expectation or rumor of central bank intervention might be enough to stabilize a currency, but aggressive intervention might be used several times each year in countries with a dirty float currency regime. Central banks do not always achieve their objectives. The combined resources of the market can easily overwhelm any central bank. Several scenarios of this nature were seen in the 1992–93 ERM collapse, and in more recent times in Southeast Asia.

Currency Risk

For example, if you are a U.S. investor and you have stocks in Canada, the return that you will realize is affected by both the change in the price of the stocks and the change in the value of the Canadian dollar against the U.S. dollar. So, if you realize a 15% return in your Canadian stocks but the Canadian dollar depreciates 15% against the U.S. dollar, this will amount to no gain at all.

Academic studies of currency risk suggest - although without absolute certainty - that investors bearing currency risk are not compensated with higher potential returns, meaning it is essentially a needless risk to bear.

Currency Trading Pips and Ticks

A pip is the smallest change of price for any Foreign Currency. The currency quotes appear as numbers with either two or four decimal places. This means that if the Foreign Currency moves up or down, the smallest move is called a "pip". When you trade in Forex, you monitor how the pips rise and drop and this is what determines your investment.

An example of this is if you buy EUR/USD. This pair is quoted four decimal numbers after the point. A pip here is ten thousandth of a Dollar, or 0.0001 of a dollar, meaning 1/100 of a cent. The pip is an abbreviation of "Price Interest Point", and this is why another name used for pips is points.

Even though a pip is only a small amount of money, because your foreign currency trading is usually a leveraged investment, a few pips can mean serious cash fluctuations. Each serious trader needs to know how to calculate the change from pips the actual sums invested, and some online Foreign currency trading agents offer such calculators in their account. You should consider these and other advanced functions when selecting the broker you want to use. Pip value can vary, and is usually $1 in mini accounts or $10 in regular accounts.

An important concept that concerns pips is called The Spread. This is the pip difference between the bid price and the ask price done for the currency trading sum. When you buy Foreign Currency it costs you more than to sell it and this is the spread.

Ticks are the smallest amounts of time that exist between two currency trades. This time frame can be a short time period of a fraction of a second for major currencies, or can also be a time frame of a few hours for less popular currencies. Ticks do not happen in constant intervals, even though the charts used for technical analysisdo use specific time rates such as 4 hours of 15 minutes.

Currency Trading Leverage and the Margin

Leverage is when your invested cash is used to buy or sell foreign currencies that are worth far more that the investment. Simply put,leverage gets you more currency than you pay for.

When you buy\sell a leveraged currency, the sum you invest is called the Margin. The margin is used by your broker as a deposit for the currency you buy or sell.

A Leverage investment works as the following example:

- You buy/sell foreign currencies for $100

- You receive a leverage with a ratio of 100 to 1

- Your investment is now worth $10,000

Foreign currency trading companies have various criterions for opening a margin trading account, and there are different margin accounts availablefor you. usually moving from one to two thousand dollars deposit for each trading day. Upon opening an account the trader gains overwhelming leverage – up to 0.5%! In example - in order to execute a 200,000 dollar transaction you'll need only 1000 dollars in your margin trading account, thus minimizing the personal funds invested in every transaction.

With leverage you not only win big, but lose big - It's very important to remember that a margin account can enlarge your profits as well as your losses. So while you are upscaling your currency trading profits, any losses will also become greater for leveraged foreign currency. If you get a margin call, it means you've lost 75% of your initial investment, and you need to invest more to continue having the leveraged currency.

Leverage allows more people to trade - As a result of the size of the forex market (more than 1.9 trillion dollars each day), most of the trade is being made in $10,000 lots. This could have blocked the small forex traders, who are reluctant to risk such sums, out of the forex market. Fortunately the forex market provides extensive leveraging options that are far better than you can find in any other financial market.

The initial margin requirement is the minimum investment you need to make in a foreign currency trading action. Your margin account is very much like your regular bank, where you can deposit and withdraw your capital. All of the margins accounts are closed at the end of the trading day and all gains and losses are assessed into the end balance. This is called the Rollover.

Cyborg Automated Forex Trading System

This part human - part machine currency trading strategy trades a dozen different Forex strategies with the parameters set by us each and every day! It's very hard to create an automated Forex trading system as markets constantly change so we tell it everyday at what zones to LOOK for Forex currency buys & sells and WHEN to look for counter trend trades!

A computer can not do multi time frame Forex analysis as well as a professional trader can and that's why so many Automated Forex Systems fail miserably as online Forex markets are constantly changing. They just can't adapt, but our Cyborg FX System automatically adapts each day as we read the market and make changes to it!

Thursday, November 19, 2009

Euro Optimism (And not just Dollar Pessimism)

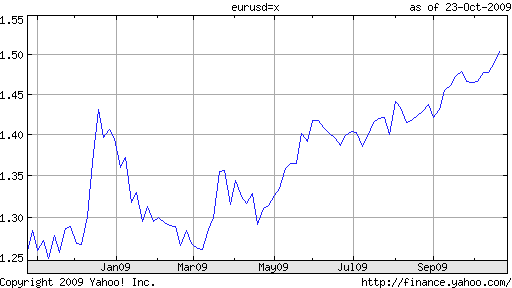

According to a recent Merril Lynch (Bank of America) survey, Europe has officially returned to favor among investors. “A net 30% of global portfolio managers see euro-zone equities as undervalued relative to other regions, the highest reading since April 2001. A net 11% are overweight Europe, the first overweight allocation in nearly two years, said Baker.”

The numbers, meanwhile, reflect this perception. Over the last month, investors have poured a net (inflows minus outflows) $2.1 Billion into EU capital markets, an impressive sum when you consider that the figures for Japan and the US were both negative. Meanwhile, stock markets in the region are up by 50%+ since bottoming last March. When you account for currency fluctuations (i.e. Euro appreciation), stock market comparisons between the US and EU start to look pretty lopsided.

According to a WSJ report, there’s no mystery behind the European stock market rally: “Even though prices have risen sharply since March, valuations aren’t stretched. Average price-to-earnings ratios in Europe, on a trailing 12-month basis, are about 16, up from seven back in March, according to Citigroup…On a price-to-book ratio, stocks are trading about 15% below their long-term average, and dividend yields compared to government bond yields are historically still very attractive.”

At this point, you’re probably wondering, “Why the long preamble on European stocks?” Because, it’s easy to forget that there are inherently two sides to every currency pair. In the case of the USD/EUR (the most frequently traded pair in the world), most of the recent commentary has focused exclusively on Dollar-negatives, portraying the dynamic as a depreciation in the Dollar. In this context, it’s easy to forget that the Dollar’s depreciation implies an appreciation in the Euro. Duh?! But seriously, for every Dollar bear, it seems there is at least one Euro bull.

To be fair, those who don’t see much to be excited about in the Euro can be forgiven. After all, the European economy is technically still mired in recession, and isn’t projected to return to growth until 2011. While some of the intangible indicators are improving, others continue to stagnate. “Industrial output in the euro zone is 20% lower than its February 2008 peak, despite some recent improvements.” In addition, the appreciation in the Euro threatens to choke off exports and stifle the recovery before it has a chance to get off the ground.

Speaking of which, the European Central Bank (ECB) will probably hold of on raising rates because of the strong currency. A more valuable Euro keeps inflation in check (via cheap imports). Besides, higher interest rates would attract carry traders hungry for yield, and would make it even more difficult to keep the Euro in check. Many EU monetary officials (including ECB President Jean-Claude Trichet) have already made their concerns about the Euro’s appreciation clear. If they are able to succed in halting its rise, that could make investing in Europe a lot less exciting…

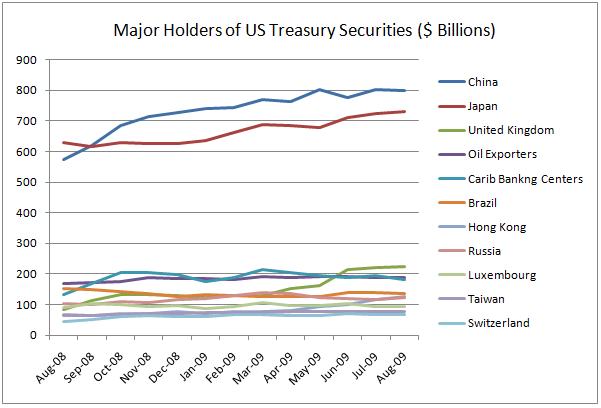

Central Banks Prop Up Dollar

By all accounts, the decline of the US Dollar has been measured, and without incident. This, despite the fact that most investors reckon the Dollar is doomed, both from a long-term and a short-term perspective. What, then, is preventing an all-out collapse?

Personally, I think the best answer is that Central Banks (and their sponsoring governments) don’t want the Dollar to collapse. In other words, a schism is forming between private investors and public government, whereby investors (on a net basis) are rooting against the Dollar, while Central Banks are rooting for it. That’s not to say that there is a global conspiracy involving Central Banks, designed to prop up the Dollar. Rather, it is that Central Banks are simply trying to protect their short-term financial interests, and long-term economic interests. By this, I mean simply that foreign Central Banks have everything to gain from a strong Dollar, and seemingly everything to lose from its collapse.

From an economic standpoint, foreign Central Banks also benefit from a strong Dollar, especially those whose economies are powered by exports. “A stronger local currency relative to the dollar attracts foreign investment and tempers domestic price pressures by keeping import prices in check, but also cuts into the competitiveness of the country’s export sector.” Given that inflation is currently a moot issue whereas economic growth remains tenuous, Central Banks have made it clear that they currently favor weak currencies. “If (their currencies have) too much strength and the U.S. recovery falters, it’s bad for emerging market growth,” and could even lead to a so-called “double-dip recession.”

In order to alleviate this possibility, many Central Banks have intervened directly in forex markets and depressed their currencies through the purchase of Dollars. During only one trading session earlier this month, “Asian central banks said to be intervening in currency markets overnight by buying dollars included South Korea, Hong Kong, Taiwan, Thailand, the Philippines and possibly, Indonesia, according to analysts.”

Meanwhile, Central Banks in industrialized countries are using increasingly strong rhetoric to try to talk down their currencies. The Banks of Canada and England have achieved modest success in the last few weeks in convincing investors that overvalued currencies would be met with decisive action. The Royal Bank of Switzerland has intervened several times, while the European Central Bank has expressed concerns about “volatility” (code for the rapid appreciation in the Euro) in forex markets. It’s still not clear where the Bank of Japan stands. The newly appointed Finance Minister has already flip-flopped several times, settling finally on a course of action that would prevent the Yen from rising too high and threatening the nascent recovery.

Consider also foreign Central Banks’ collective holdings of US Treasury securities, which increased by nearly $800 Billion over the last year, a large portion of which was accounted for by the Banks of China and Japan. According to the most recent Federal Reserve data, they are collectively adding to their stockpile at a pace of $10 Billion per week. As the WSJ explains, “The inflows highlight the challenges facing nations with large dollar holdings, particularly developing countries. A weaker dollar is, in theory, bad for their investments as it eats into returns when translated back into local currencies.”

In other words, continued foreign Central Bank investment in US Treasury securities is perhaps rooted less in investment strategy, then in the simple desire to prevent their current holdings from depreciating. At the same time, those banks that intervene directly in forex markets often have little choice other than to hold their forex reserves in US Treasuries.

You can see from this that the idea of an alternative reserve currency would actually run counter to the interests of many of these Central Banks. With the exception of a few (i.e. Iran, and to a lesser extent, China) that would like to see the Dollar fail for political reasons, the vast majority of banks have a vested interest in the Dollar remaining where it is. Otherwise, they would witness the value of their Dollar-denominated assets collapse, as well as a collapse in exports to the US.

It looks like, then, there will be a showdown at some point between the Central Banks and investors. If you accept the notion of efficient markets, then it should be obvious who will win in the long-term. On the other hand, you can’t underestimate the determination of some of these banks.

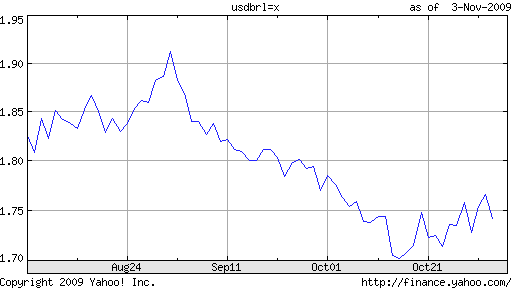

How will Foreign Investment Tax Affect the Real?

On October 20, the executive office of the government of Brazil enacted an emergency measure, calling for a 2% tax on on all foreign capital inflows. And with one foul swoop, this year’s 35% rise in the Real had come to an end, right?

The tax certainly took investors by surprise, with the Brazilian stock market falling by 3% and the Real falling by 2%, the largest margins for both in several months. The tax is comprehensive and applies to essentially to all foreign capital deployed in Brazilian capital markets, whether fixed income, equities, or currencies. While the tax doesn’t apply to those currently invested in Brazil, the possibility that it would cause potential investors to stay away was enough to cause a sell-off.

The ostensible reason for the tax levy is to prevent a further rise in the Real. By most measures, the currency’s rise has been excessive, more than erasing the losses incurred during the credit crisis. The concern is that a more expensive currency will derail the Brazilian economic recovery before it has a chance to firmly get off the ground. “Brazil’s currency needs to weaken as much as 19 percent for sustainable economic growth, said Nelson Barbosa, the Brazilian Finance Ministry’s top policy adviser.”

According to cynics, however, the tax is a backhanded effort to raise revenue to fund a growing budget deficit. The government continues to spend money (perhaps to offset the negative impact on exports brought on by the Real’s rise) as part of its stimulus plan, but is increasingly tapping the bond markets to do so. The tax is expected to bring in an impressive $2.3 Billion over the next year, which could go part of the way towards fixing the government’s fiscal problems.

The real question, of course, is how the Real will fare going forward. The initial reaction, as I said, was ‘The Party’s over…‘ But investors with a longer-term horizon aren’t fretting. “In the medium term, the measure will have a limited impact. The fundamentals point to a stronger real, with commodities rising and the dollar weakening globally,” asserted one economist. While investors aren’t happy about paying an arbitrary 2% fee to the government, such pales in comparison to the 10%+ returns that investors still aim to reap from investing in Brazil over the long-term.

Ignoring the possible bubbles forming in Brazilian capital markets (admittedly, a dubious suggestion), Brazil still looks like a good bet, especially on a comparative basis. Interest rate futures point to a benchmark interest rate of 10.3% at this time next year, compared to ~1% in the US. Even after accounting for inflation and the 2% tax levy, the yield spread between Brazil and the US remains impressive. For that reason, the Real has already stalled in its expected fall against the US Dollar, standing only 1.7% below where it was on the day the tax was declared.

It’s unclear how determined the Brazilian government is towards pushing down the Real. The comments by its finance minister suggest that the consensus is that it is not slightly – but extremely overvalued. Thus, it’s likely that the government will enact other aggressive measures to prevent it at least from rising further. It continues to buy Dollars on the spot market, and is trying to make it easier for Brazilians to take money out of Brazil. It is not yet ready to tamper with its floating currency, but by its own admission, the “government was studying additional measures to regulate the heavy inflow of foreign investments and its impact on the country’s currency.”

There are also implications for other (emerging market) currencies. As I wrote earlier this week (”Central Banks Prop Up Dollar“) a number of Central Banks have already intervened or are currently mulling intervention in forex markets, to push down their currencies. You can be sure that other governments will be studying the situation in Brazil closely, with the possibility of implementing such policies themselves.

Forex Implications of China-US Economic Codependency

The Economist recently published a special report on China and America (”Round and round it goes“). As the title suggests, the article described the increasing interdependency between the economies of the US and China. In a nutshell, China maintains an undervalued currency, in order to stimulate exports. The resulting overseas (American) demand puts upward pressure on the RMB, which China defuses by buying US Treasury securities. This results in artificially low US interest rates, causing American consumers to import more, putting even more pressure on the RMB, which is further defused by buying more US Treasuries. And the cycle continues ad nauseum.

The article focused primarily on the political side of this precarious relationship, at the expense of the financial implications. It got me thinking about the forex forces at work, and how a disruption in the cycle could have tremendous ramifications for currency markets. It’s clear that in its current form, this system keeps the Yuan artificially low, but does that means that the Dollar is also being kept artificially high.

Given the depreciation of the Dollar over the last six months, this seems almost hard to believe. Over the same time period, though, China (as well as many other Central Banks) have vastly increased their Treasury holdings. This would seem to imply that indeed, the Dollar’s fall has been slowed to some extent by the actions of China. It’s kind of a paradox; as US consumers recover their appetite for Chinese goods, the Dollar should decline. But as China responds by plowing all of those Dollars back into the US, then the net effect is zero.

As the Economist article intimated, there are a couple of developments that would seem to upset this equilibrium. The first would be if the Central Bank of China began diversifying its forex reserves into other currencies. By definition, however, it would be impossible for China to continue pegging the RMB to the Dollar without simultaneously buying Dollars. Thus, the day that China stops recycling its export proceeds into the US, the RMB would start to appreciate, almost instantaneously. In addition, the sudden surcease in US Treasury bond purchases would cause interest rates to rise. Both higher rates and a more expensive currency would presumably result in lower demand for Chinese exports, and hence eliminate some of the need to recycle its trade surplus back into the US. In this way, we can see that China’s Treasury purchases are actually self-fulfilling. The sooner it stops purchasing them, the sooner it will no longer need to purchase them.

I’m tempted to elaborate further on this point, but it seems that I’ve already taken it to its logical conclusion. China must recognize the dilemma that it faces, which is why it refuses to break from the status quo. If it allows the Yuan to appreciate, it will naturally face a decline in exports AND the relative value of its US Treasury holdings will decline in RMB terms. Both would be painful in the short-run. However, by refusing to concede the un-sustainability of its forex/economic policy, China is merely forestalling the inevitable. With every passing day, the adjustment will only become more painful.

Emerging Markets Bubble Continues to Inflate, but for How Long?

Yesterday, emerging markets (proxied by the MSCI Emerging Markets Index) recorded their biggest fall since July, ending a week of solid gains. Still, this one-day slide of 1.4% pales in comparison to the nearly 100% gain that the index has achieved since bottoming last March. In other words, while investors might be starting to pull back, the direction of asset prices is still upward.

As for what’s causing this across-the-board appreciation, that was the subject of my previous post (Inverse Correlation between Dollar and Everything Else…Still), in which I merely stated the obvious; that the Fed’s year-long program of negative real interest rates and quantitative easing (i.e. wholesale money printing) has unleashed a flood of cash into global capital markets. Since we’re not just talking about the Dollar, here, it makes sense to point out that the Fed’s easy money policies have been copied by Central Banks in most other industrialized countries, including the UK, Canada, Switzerland, Sweden, and to a lesser extent, the EU.

As for why emerging market assets and currencies seem to be outpacing appreciation in other asset classes, that’s also not difficult to explain. First of all, by some measures, emerging market stocks have hardly outperformed other assets. Oil, for example, has risen by 131% in less than a year, to say nothing of other commodities. Still, by other measures, growth has been remarkable. Most emerging market stock indexes and currencies have fully erased (or come close to erasing) the losses recorded during the peak of the credit crisis. Bonds, meanwhile, have gone one step further. Yields are collapsing, and prices have exploded – by 25% in the last year, sending the JP Morgan Emerging Market Bond Index to a new record.

Is it safe to call this a bubble? Intuition would suggest so; given that all assets are rising across the board, without regard to particular fundamentals, it would seem that only a herd/bubble mentality could offer an explanation. Some analysts, in fact, have given up completely on fundamental analysis, instead using fund inflows (i.e. investor demand) to predict whether some emerging market assets will continue rising. As Nouriel Roubini (the NYU economist that famously predicted the credit crisis) summarizes: “Traders are borrowing at negative 20 per cent rates to invest on a highly leveraged basis on a mass of risky global assets that are rising in price due to excess liquidity and a massive carry trade.” P/E ratios are nearly twice as high in some emerging markets, compared to stocks in the S&P 500.

On the other side of the equation are the bulls and the efficient market theorists.”By historical price-to-earnings ratios — the ratio of stock prices to per-share profits —these levels can be justified, if the economic recovery continues. With massive layoffs, business costs have been cut sharply. “The hope is that when consumers and companies start spending, the added sales will drop quickly to the bottom line [profits].” Other proponents argue that the rise in asset prices is exactly what the Fed wants, since it implies that the markets are once again characterized by stability and liquidity.

Regardless of whether growth materializes, however, that doesn’t change the fact that the free ride can’t and won’t last forever. At some point, Central Banks will be forced to raise interest rates and start withdrawing Trillions of Dollars from global capital market. This will cause the Dollar to rise, and investors to rapidly unwind their carry trade positions. Warns Roubini, “A stampede will occur as closing long leveraged risky asset positions across all asset classes funded by dollar shorts triggers a co-ordinated collapse of all those risky assets – equities, commodities, emerging market asset classes and credit instruments.”

If the tech-bubble and real-estate bubble taught us anything, it is that there is no free lunch in the markets. It is not possible for all investors in all assets classes to simultaneously win. At least, in the long-term. In the short-term, meanwhile – it pains me to say this – let the party continue. My only warning is this: when the music stops, don’t be the one caught with your pants down…

Thursday, November 5, 2009

Forex Training: What to Look for in a Forex Training Program

Should new Forex traders take Forex trading courses or join a Forex training program? Definitely yes; by now you have probably heard that only 5% of traders achieve consistent profitable results when trading the Forex market. The main reason for this is the lack of education. Don't get me wrong here, taking a Forex training program or a Forex trading course won't guarantee profitable results, nothing can, but choosing the right Forex training program or Forex trading course will definitely put the odds in your favor.

Before spending any amount of money on any Forex trading course or Forex training program there are some important aspects you need to take in consideration. There are many training programs available, but not every one of them suits the needs of every trader.

The first thing you should be looking in a Forex training program is the content of the material. Unfortunately, most courses or training programs focus or spend most of the time on basic concepts. Though these basic concepts are important, spending most of the course on them won't help the trader to make consistent results.

The following subjects are what I consider the most important aspects of trading and every training program or trading course should address:

Forex trading basics.

Review basic concepts such as: margin, type of orders, a little background, bid/ask, rollover, etc. You need to make sure you understand every single concept to perfection.

Main drawbacks of Forex traders.

Being aware of the common mistakes made by Forex traders and knowing how to handle them will prevent new traders from making those mistakes.

Technical and fundamental analysis.

These are the two main approaches adopted by Forex traders. Knowing how to properly apply each concept will definitely put the odds in your favor.

The three pillars of Forex trading. I consider that these three subjects have the most impact on every trader trading account.

Forex trading system development.

Having the right system is a must if you want to have consistent profitable results. Having a system that doesn't fit you will cause a series of problems that will make your trading account vanish away (second guessing the system, not following your system, etc.)

Money management.

This is considered by many successful traders to be the most important single aspect of trading. Money management helps to increase your profits geometrically and at the same time limit your losses (i.e. a good risk reward ratio of about 2:1 will make you money in a Forex trading system that is right only 38% of the time.)

Trading psychology.

Being aware and knowing hot to handle the psychological barriers that affect every trader decision will put the odds in your favor.

Other important aspects every training program should include are:

Developing habits for success (such as discipline patience, taking responsibility of every action, commitment, etc.,) understanding and taking our trading as a business, risk and trade management.

Another important aspect you should take into consideration when choosing a Forex training program is the mechanics of it, getting to know how the training program works.

A good course will have the following:

A live conference room, where you can apply everything learned under live market conditions.

One-on-one feedback, every trader has different needs and requires special attention. For instance a trader wanting to improve the system and requires individual feedback from the instructor about it.

Online trading course, a course that could be accessible through internet. A plus is a course where you are able to access the course at the convenient time for you, so you don't have to change your lifestyle.

A forum, where members can talk just about everything related to the Forex market and the Forex training program.

Trading the Forex market is no easy task. It requires a lot of hard work. Making the right decision will definitely put the odds in your favor. Take your time when doing your diligence because it is a big and important step in a trader's trading career.

Relative Strength Analysis In Forex Trading

First what is Forex: The FOREX or Foreign Exchange market is the largest financial market in the world, with an volume of more than $1.5 trillion daily, dealing in currencies. Unlike other financial markets, the Forex market has no physical location, no central exchange. It operates through an electronic network of banks, corporations and individuals trading one currency for another.

Analysis means: Research used to assist in predicting the direction of the markets based on technical data relating to price movements of the market, or on fundamental data such as corporate earnings.

The relative strength analysis is a technical report that allows investors and brokers to make informed decisions about trading on the Forex. The Forex, also known as the FX or foreign exchange market is the most liquid of all markets in the world. Over two trillion dollars changes hands everyday through the foreign exchange market. There are many factors that affect both the stock market and the foreign exchange market.

When investors and brokers look at the relative strength analysis, they are getting a picture of how the trends in the Forex should go. This analysis allows brokers to see current trends in the foreign exchange market and allows them to know if they are interested in buying or selling currency at any given time. This can help an investor or financial institution make educated decisions on which markets are gaining and which ones are losing.

There are many factors that affect the exchange rate in the Forex. These factors can include political events, governmental policies, inflation, and current trends in the importing and exporting business, consumer opinions and even natural disasters all over the world. The relative strength analysis looks at all of these factors. The past trends in the Forex are also taken into consideration, but are not the only thing that is looked at when forecasting this type of market.

The relative strength analysis compares all foreign currency and the exchange rates every day. The report will then be sorted by their strength rating and ranked according the previous week's rating. This report relies on at least 45 weeks of data so that sustained growth can be seen with ease. Using this analysis promises to be one of the most valuable tools of forecast the trends in the Forex. In addition, it can show the rating of stocks and rate them into which ones are the strongest. The stock market has a direct relation to the foreign exchange market because it reflects current trends in buying and selling, which will increase or decrease the value of currency.

The current trend in predicting the trends in the Forex is to use not only the relative strength analysis, but to also look at other factors such as the stock market barometers and economic factors. When investors and brokers look into all of these factors when forecasting the Forex, it makes for a highly reliable means of predicting trends. This can be the vital difference between making money and losing money on the foreign exchange market.

When using the relative strength analysis in relation to the foreign currency exchange, it is possible to tell which markets are performing well and which ones are not. The key is finding the markets and currency that are moving up on the ranking scale. It is important to remember that like stocks, the Forex is affected by a variety of factors. The relative strength analysis can help investors find which ones are good investments. This report is based mostly on a stock's closing price and the relative strength analysis is based on gains and losses. The report can calculate the markets report for any period in time.There are several benefits to using the relative strength analysis when attempting to forecast the Forex. When an investor looks at the relative strength of a certain stock, it affects the foreign exchange rate. One with a strong relative strength is ideal, but the value on these will not be low. Investors can look at a stock that is increasing in values and used the relative strength to measure whether or not this particular stock is moving up because it has a history of increasing or if it has a sustained high value. Stocks with a good relative strength over a constant, steady time period are good performers in the Forex market.

The Power of Small Consistent Returns

For most of us, 'safe investments' are limited to the rate of return that we can earn on our savings accounts or long-term deposits. The return would depend on the interest rate applicable in each country. At the time of writing, November 2007, the interest rate earned on a savings account in Australia is around 7% a year. That is a return of 0.57% a month. Despite this fact, many have preconceptions regarding the type of returns they can make from trading the financial markets.

A novice trader puts on a winning trade and gains between ten to fifty percent of his trading account. He forms a belief that, by trading, he can quickly become a millionaire. Indeed, if we assume a 20% return per month on a $10,000 trading account, we can expect $89,161 by the end of our first twelve months of trading. What if we assume an estimate of 50% return per month? We would have $1,297,463 by the end of the year. Of course, the problem with expectations like these is that they are unrealistic. Even most of those who claim to have made these types of returns have only done so in simulated environments, in trading competitions using game accounts, for example, where real money was not at risk.

It is possible to make these types of returns for a short while but I have not heard of anybody achieving such steep returns consistently year after year. After testing hundreds of trading systems and ideas I have come to believe that systems, which seem to promise exorbitant returns, turn out to be over-optimized for the period they have been tested on. Or even worse, they have flaws in their logic or assumptions.

Lately, I have been looking at the performance reports of trading firms in the USA. What would you say if I told you that the top trading firm over the last ten years only made an average return of 25% a year and the median trading firm made somewhere around 15% a year? Well, this is in fact what I am telling you.

A 20% and a 15% return a year is 'only' 1.877% and 1.171% return a month, respectively. I am sure that many novice traders and investors reading this article will have a mix of reactions towards these figures. Some might laugh and scoff at such 'paltry' returns, secretly believing that they can do a lot better than just 1.877% a month. Others may be surprised or even disappointed because their dreams of living rich will not come as quickly as they hoped.

Setting aside your initial reaction to these figures however, let us refocus on what these numbers actually mean in the real world. I would like to show you that these types of returns are very powerful. With time, these seemingly small, but consistent, gains will give you enormous profits in the future.

15% A YEAR RETURN ON A $10,000 ACCOUNT

Let us start with the assumption of having a $10,000 account, making at least 1.171% return a month, or 15% a year, trading the market. Based on these, the projections are:

- $11,500 (15% growth) after 1 year.

- $13,223 (32% growth) after 2 years.

- $20,108 (101% growth) after 5 years.

- $40,432 (304% growth) after 10 years.

- $163,475 (1535% growth) after 20 years.

- $660,960 (6510% growth) after 30 years.

25% A YEAR RETURN ON A $10,000 ACCOUNT

Let us now assume having a $10,000 account, making at least 1.877% a month, or 25% a year, trading the market Based on these, the projections are:

- $12,500 (25% growth) after 1 year.

- $15,625 (56% growth) after 2 years.

- $30,519 (205% growth) after 5 years.

- $93,140 (831% growth) after 10 years.

- $867,512 (8575% growth) after 20 years.

- $8,080,034 (80700% growth) after 30 years.

It is very important to note that not all fund managers make money. Returns of 15% or 25% a year belong only to those money managers who were consistently profitable. Furthermore, these types of returns are out-of-bounds for most investors. To invest in such schemes, most of the fund managers I have been looking into will deal with you only if you are a 'sophisticated' investor with a spare $500,000 minimum to invest. In fact, the highest earner only took on investors with a minimum of $25,000,000 US dollars to invest. (I will not mention any names here, however, you can do your own research by typing "commodity trading advisors" in your favourite search engine.)

I do not know about you but I certainly do not have 25 million dollars lying around, to hand over for someone else to manage. The dilemma, however, is that life is way too short for me to be satisfied with a 7% annual return either. I guess this is why you and I have taken the decision to trade and invest in the financial markets ourselves. At least there, we have full control and responsibility over the returns we get. It has its risks, but we can all avoid being reckless if we keep realistic expectations.

What's Fibonacci Forex Trading?

Fibonacci forex trading is the basis of many forex trading systems used by a great number of professional forex brokers around the globe, and many billions of dollars are profitable traded every year based on these trading techniques.

Fibonacci was an Italian mathematician and he is best remembered by his world famous Fibonacci sequence, the definition of this sequence is that it's formed by a series of numbers where each number is the sum of the two preceding numbers; 1, 1, 2, 3, 5, 8, 13 ...But in the case of currency trading what is more important for the forex trader is the Fibonacci ratios derived from this sequence of numbers, i.e. .236, .50, .382, .618, etc.

These ratios are mathematical proportions prevalent in many places and structures in nature, as well as in many man made creations.

Forex trading can greatly benefit form this mathematical proportions due to the fact that the oscillations observed in forex charts, where prices are visibly changing in an oscillatory pattern, follow Fibonacci ratios very closely as indicators of resistance and support levels; maybe not to the last cent, but so close as to be really amazing.

Fibonacci price points, or levels, for any forex currency pair can be calculated in advance so that the trader will know when to enter or exit the market if the prediction given by the Fibonacci forex day trading system he uses fulfills its predictions.

Many people tries to make this analysis overly complicated scaring away many new forex traders that are just beginning to understand how the forex market works and how to make a profit in it. But this is not how it has to be. I can't say it's a simple concept but it is quite understandable for any trader once he or she has grasped the basics and has had some practice trading using Fibonacci levels along with other secondary indicators that will help to improve the accuracy of the entry and exit point for every particular trade.

Free chapters of a forex day trading system can be downloaded at http://www.1-forex.com in case you are interested in learning more about Fibonacci forex trading.

Build a Forex Trading Account You Can Be Proud of

How can you increase the size of your Forex trading account and continue to make good profits from trading the Forex market? The following points will help prove this can be done.

The Forex market will move in one of three ways, up, down or sideways. Your challenge is to develop a strategy which covers all eventualities.

If you prefer to scalp for a few pips based on a higher value lot size and trading many times a day, then your Forex trading strategy will be developed to maximise this plan.

If you trade intra-day, then you might only place a handful of trades per day and look for a greater pip gain. This would mean a sideways moving market is not for you and you would make the decision not to trade.

With Forex trading, it is commonly agreed that knowing when not to trade is as important as knowing when to trade!

Go through the motions of building the foundations to your career. Paper trade first until you are consistently successful, comfortable and confident with your strategy. Use a Forex trading demo account next to get to know your Forex broker's trading platform which will be a great help when you start to trade a live account!

Do you know your risk to reward strategy?

This is the amount you are prepared to risk in order to make a gain and is typically based on a 3 to 1 ratio. So if your stop loss was 10 pips below your entry point for a long trade, you would expect your trade to achieve a minimum of 30 pips.

This takes care of the risk management of your trade but what about the risk to your Forex trading account? How can we best protect your hard earned money and trading capital?

Well, we look to use a similar ratio for this too. The thought process is not to risk more than 3 percent of your total Forex trading account size on each open position. So if you had $1000 in your trading account you would only risk a maximum of $30 on each trade. If your stop loss was 10 pips, that would mean you could trade at $3 per pip and if your stop loss was 15 pips your trade would be based on $2 per pip.

Can you see how this strategy means you will be in the market long enough (assuming you activate your stop loss) to learn about trading and how to make profits?

If you keep growing your Forex trading account size in this way, you will achieve a growing trading balance, whilst protecting your capital.

This way you will still be trading having kept your trading account in order - achieving more than 90 percent of all other traders! If you reach this stage, you would have done very well indeed!

So, with Forex trading, by knowing which way the market is moving, you can apply to right strategy to trade, or not. Once you have your trading plan written, you can start paper trading, progressing to opening a demo account with a good Forex broker and finally on to a live account. Make sure you understand the risk strategy and grow your trading account slowly.

This will ensure you build the foundations of your Forex trading account and be proud of what you have achieved!

Forex Market Books

Almost all Forex e-books are in .pdf format. You'll need Adobe Acrobat Reader to open these e-books. Some of the e-books (those that are in parts) are zipped.

If you are the copyright owner of any of these e-books and don't want me to share them, please, contact me and I will gladly remove them.

Screen Information, Trader Activity, and Bid-Ask Spreads in a Limit Order Market — An in-depth work on a Limit Order Market by Mark Coppejans and Ian Domowitz.

Strategic experimentation in a dealership market — by Massimo Massa and Andrei Simonov.

Limit Orders, Depth, and Volatility — by Hee-Joon Ahna, Kee-Hong Baeb and Kalok Chan.

Reminiscences of a Stock Operator — the best of the best book on financial trading by Edwin Lefevre.

Market Profile Basics — by Jayanthi Gopalakrishnan.

Quote Setting and Price Formation in an Order Driven Market — by Puneet Handa, Robert Schwartz and Ashish Tiwari.

Phantom of the Pits — General thoughts and opinions on trading and market by Arthur L. Simpson.

An Introduction to Market Profile and a User's Guide to Capital Flow Software — by J. Peter Steidlmayer and Ted Hearne.

The Effect of Tick Size on Volatility, Trader Behavior, and Market Quality — by Tavy Ronen and Daniel G. Weaver.

Trading as a Business — by Charlie Wright.

What Moves the Currency Market? — by Kathy Lien - Find out which economic factors help shape the short-term and long-term forex landscape.

Macroeconomic Implications of the Beliefs and Behavior of Foreign Exchange Traders — by Yin-Wong Cheung and Menzie D. Chinn.

All About the Foreign Exchange Market in the United States — by Sam Y. Cross — a general review of the Forex market made by the Federal Reserve Bank of New York in 1998.

Tuesday, September 8, 2009

Forex Trading System Tips - Forex Charts and Signals

Forex trading systems have many tools that can help you to decide what currencies might be a good investment. If you have never used the Forex markets before, you need to do some research on the market in order to make informed decisions. Don't be overwhelmed by the amount of information available; there is a great deal of it. Start slow and learn about the market and the platforms available.

Once you have formed a strategy that you believe will work for you, it is time to practice, practice, and practice. Many companies have demos that you can try to see if your system would have worked on past events. Some have options to let you try them out in the current market without risking any of your capital. Once you have a strategy, you need a platform.

As part of the demos you explored, charts are often provided. Examine how these charts predict the changes in the market. Searching online for more information about charts will bring back an enormous amount of information. After a little research, you should begin to feel more comfortable with the charts and the information they provide. Compare and contrast the different types of charts to see what information each can provide you.

The more experience you gain in the Forex market will provide you will the ability to understand the charts and you will become more meticulous in which charts you use. Your system may have charts that do not provide you with all the information you want, but you can find other charts online that may fit your needs better. Many other features are available on most of the charts but are often overlooked by novices. Forex signals are standard on most systems. How these signals are used by the charts is not.

In the beginning, you might ask for advice from your friends, but don't stop there. Just because one set of charts or signals works for your friend does not mean they will fit your Forex strategy or style of trading. You should learn the charts from several different systems in order to find one that is the right fit for you. Just like a marriage, you will be spending a lot of time together, so choose carefully which platform, charts, and signals best fit you.

Feel free to take tips and suggestions from friends, Internet articles, other traders, but find a way to make the charts and signals work for you. The perfect fit will be one you are comfortable with.

Forex Trading System - You Can Experience the Process

Firstly, get committed before you decide to invest in a Forex trading system. You should have gone through a few experiences of positive and negative trading before you take this decision. Systems have the capacity of breaking down large bodies of information in an easily decipherable manner. However, it may not seem easy to all, more so to the new ones in the business. Keep in mind that you need to scour the market for suitable systems and training support even for obvious questions.

What It Does

The Forex trading system is a tool that provides you a quick view of the performance of a currency over a past period. You reduce the risk of hoping that a decision to buy or sell is correct at a certain point of time on the basis of the quick view. The system is essentially a repertoire of past currency value data and keeps renewing its huge database on a real time basis through the internet. When you choose the currencies that you are playing on, the system retrieves relevant information from its database and presents it to you in a graphical manner to view the trends clearly.

What You Can Do

Keep in touch with the subject and increase your understanding of how a Forex trading system can help you. You should keep using the system to get familiar with the icons and menu functions. Download reports and browse through them to see whether you have understood the information presented. Take a few decisions with small sums and see how the system is able to support your capability to make profits. At some times, you will find that the system is correct about the data it puts forth but you need more inputs about why a certain shift is occurring. The information from the system is purely indicative of a country's situation based on the indices it is working on. You need to be alert to other factors that are affecting the country to gauge whether a trend is going to last long.

How Is It Helpful

The main advantage of the Forex trading system is its capacity to alter its report preparation to suit your needs. If you decide to play on multiple accounts with the currencies of different countries, a single system can provide you the necessary supporting information to move ahead. In the presence of a system, you are up to date in your information and have only to contend with external shifts in reality. Depending on your capacity to take risks, the system can consider a larger or smaller number of performance indices and reach you to a more conservative approach. You can tinker with the software to suit your preferences.

Types Of Trading

The Forex trading system is equipped with the capacity to handle different type of trading that you might want to enter into. You may decide to play the spot market or the forward market. In the former, once your agreement with the broker has been completed, the system will make the suitable accounting entries.

A Forex Robot Can Decrease the Learning Curve to Profitably

Getting into the forex market means you can trade 24 hours a day. Now you can get your piece of the trillions of dollars that are traded daily. But is it possible? All in all it is almost impossible to keep up with everything that is happening that affects the market on your own, but what if you had a robot to do it for you?

To trade profitably you will need to know a lot more than what you read in newspaper, you may want to follow charts, read some books, watch the market trends plus figure out a way to keep track of what is going on. Plus you will want to implement a trading strategy that you use with great discipline and not let your human emotions get in the way. Or you can take advantage of technology and purchase one of the forex robots and make money on autopilot.

Multiple forex trading robots are available they are computer software with no human feelings or emotions. Forex robots can follow the market 24 hours a day if you wish, which is impossible for a person. A good Forex Robot can give you profitable trades most of the time.

Highly rated forex robots need no human interaction once set up, except to check your bank account. You can allow the robot to work for you. You can always dig into and research how the forex market really works, but at the same time you have a robot doing the trading for you.

When you decide that getting into the forex market is for you; getting forex robot software would be your next logical step. put it on a practice account first, this way you will have the knowledge first hand on how it is going to trade for you. Practice accounts are free and the market is not going to disappear before you are ready for live trading.

Now you can get your piece of the trillions of dollars that are traded daily without spending huge dollars or years of training. Several Forex robots are available.

Is Automation the Best Forex Trading Strategy?

Did you know that you can fully automate your Forex trading strategy using Forex robots? A robot is a Forex program that you can install in your computer. It will trade for you on auto pilot.

Using Forex robots is best if you want to minimize your risks at the Forex market. That is because robots can accurately calculate and predict the movement of the market. So, is automation the best Forex trading strategy that you can use?

The answer to this depends on you. If you are comfortable in allowing computer software to handle your financial transactions, then you can use such robots for trading at the Forex market. On the other hand, if you are a take charge guy and you want to have hands-on experience at the market, then dump the robot and learn Forex the traditional way.

You need to understand however, that an automated Forex robot has been configured with a specific trading system. You can customize its behavior but it will still follow a pre-programmed system.

To learn if you will be comfortable with the Forex system of your trading robot, then test it first before you use it in the real market. This way, you can see if the strategies and systems of the robot will make money for you or not.

Developing a Forex strategy is critical if you want to succeed at the Forex market. However, if you want to skip the painful learning process of studying different strategies, then you can simply use a robot and automate your Forex trading strategy.

What is the Best Forex Trading Strategy For Big Gains?

There is no single best Forex strategy but the one enclosed is one of the best and the reason it is is because: it will catch all major trends, is simple to understand, and will only take you 30 minutes a day to execute. Let's take a look at it.

How do Forex prices move? If you look at any chart, you will see they trend for long periods in a sustained direction and these trends can last for weeks, months and in some instances, years.

You can see this on any currency chart but you have to get into these trends and if you take a look at any currency charts closely, you will see that every major trend in any bullish currency, starts from a breakout to new highs and continues breaking new highs, as the trend advances.

So you want to get in on the big trends and the best way to do this is to simply go with breaks of resistance to new market highs. We will look at how to spot the best breakouts in a moment but lets stress a point which is important - despite this being a logical and obvious way to make money, most traders simply don't buy breakouts.

Most traders simply can't buy breakouts because they want to get in right at the bottom of the trend and they predict which is another word for hoping and guessing and lose. They won't buy breakouts, because they feel they haven't got the exact bottom and want to wait for a pullback - this never occurs on the best breakouts and the trend carries on, away from the breakout point.

The smart trader doesn't predict, he just trades the reality of the break and he misses the first bit of the move but compensates himself with the fact that, the odds are on his side and there is probably a lot of profit ahead. He doesn't want to be smart or clever and get the exact turn, he just wants to make money.

Not all breakouts make money, therefore you need to be selective in the breaks you buy. Look for a number of tests to occur before the break occurs and we very often look for double figure tests before the breakout and view the minimum number as four tests. In breakout trading the more times a level has held before the break, the more likely the breakout when it comes, will be a good one.

This is a simple strategy and it works. You can use basic bar charts and just trade price action or you can add a few indicators in to confirm your trading signal, if you wish and one or two to confirm is fine.

Trading breakouts and holding long term trends, will take you about 30 minutes a day but the profits from your work can be huge and give you a great second or even life changing income.

The Most Reliable Online Forex Trading Strategies

There are a lot of people who offer online Forex trading strategies. But are they really reliable? It would seem so overwhelming that there is a lot of advice being given around that choosing which one to follow will certainly be a challenge.

Of course, you always have the option of making up your own strategies, although that will surely take a lot of time and effort; time and effort you may not be willing to give up.

There are a lot of strategies out there. Each one offers a particular advantage over the other, but in the end, all of them have the same goal: to help you realize profit on your investment. These are some of the most reliable strategies that can help investors realize profits while protecting themselves:

One trading strategy is referred to as the Leverage. This allows stock market traders to make use of more funds than the ones they deposited. This helps them get the best out of the benefits of Forex trading without the need to put in more deposits. Actually, with this strategy, you can multiply the amount of your deposit a number of times to allow you to purchase shares of higher prices. This is a strategy that is quite simple in concept and is widely used by investing businessmen.

Another strategy is the Stop Loss Order. This particular strategy is designed for the protection of investors by placing a limit on the investing power of the same. Once this limit is reached, the investors will no longer trade. This way, the investors do not run out of funds and are able to make investments in other areas.

The Automatic Entry Order is also commonly used. It only allows the traders to place their investments when the price is amiable for them to purchase shares. There is a prior predetermination of the price that the investor is willing to pay.

Whatever strategy an investor will choose to use will depend on his preference. Some strategies may work for one without working for the other. This is because every investor wants to realize profits in their own way and in their own pace. Using these practical strategies will surely help the investor make his choice in what stocks to buy and when to buy them. Online Forex trading strategies are, after all, simple guides to survive in the world of stock trading.

Forex Trading Strategy is the Key to Success

Before stepping into the Forex trading market, you need to have a certain strategies in mind. A well thought out Forex trading strategy can be your key to success. It can also keep you on the safer side and help to minimize your losses.

Implement a Proper Trading Plan and Don't Trade Beyond Your Means

It is very important to have a trading plan and when dealing in Forex trading. Once you have a plan, let nothing deter you from it. Remember, there is no place for emotions in trading. Following your emotions blindly is a sure shot recipe to disaster. Whenever you trade, it should be in a cool and calm frame of mind.

A very good Forex trading strategy is that you should only speculate with money that you can afford to lose. Not to say, that you want to lose anything, but whenever you invest money or trade in it, you should always use money that you can do without, money that is in excess of your requirements. It is never a good idea to touch upon the money that you require to run your house and fulfill the basic requirements of your house.

Understand the Trends of the Market

In Forex trading, market trends are your closest friends. If you are able to understand trends and make somewhat accurate predictions, you will be quite successful as a trader. Understand that there may be short term fluctuations in the currency values. After all, the market is volatile. However, you should always refer to the long term trends and not be worried about periodic ups and downs.

Another important Forex trading strategy is riding the Forex market till it shows signs of turning around. Do not be greedy and ride the win too long, else you might just be caught off guard and lose money.

Trade Wisely

A lot of newcomers tend to look for some signs or leading indicators that will help them make a good trading decision. The truth is, in the Forex market, there is no guarantee that you'll be able to predict the future accurately. Some software can help you make calculated speculations, but they could easily swing one way as the other.

A sound Forex trading strategy is that you should stick to popular currency for trading and stay away from thin market. Since there is very little public participation in the thin market, you will not be able to liquidate your position easily. Moreover, trading in too many markets is not advisable. Stick to the popular currency pairs till you learn to do better.

Update your Knowledge

Lear, learn and learn some more - and that's a Forex trading strategy that will never fail you. Work towards gaining in depth knowledge in this field, so that you can become an astute trader. Read up as much as you can on the subject and add to your existing information. While a newcomer can get by with some general guidelines and tips, a seasoned Forex trader will need more knowledge to make decisions.

Trading Forex - Intervention in Canada?

Financial panic of 2008 caused many currencies to dramatically fall in value. In search of safe haven. investors and speculators alike flocked to the safety of US Dollar. At the same time last phase of carry trade unwind lifted Japanese Yen and put additional pressure on all other currencies. As a result, many of them fell dramatically, with some reporting 40%-50% declines. Huge moves by the standards of currency trading.

With normalization of global financial markets this year, money started to flow out of the Dollar. Once again market participants are willing to take a little extra risk in search of increased returns. This, over time, benefited many currencies which suffered the most during preceding market meltdown. Rising confidence slowly, but surely, pushed higher raw materials, like crude oil. This, in turn had positive effect on commodity currencies like Canadian, Australian and New Zealand Dollars.

In spite of increased confidence by investors world wide, economic conditions are far from levels that are considered normal. Unemployment remains on the rise, economic output is off the mark set in previous years and credit is tight. All that, even though central banks of most countries flooded financial markets with money through quantitative easing and slashing interest rates to record lows. In this environment, some governments came to see strength of own currency to be a competitive disadvantage and are taking steps to end it.

Swiss National Bank was the first to act. After repeated warnings,SNB intervened in the open market by selling Franc and denominated securities. This has happened at least three times in the course of last few months. We don't know if this action achieved results sought by central bank, but one thing is for sure- Swiss franc didn't make any new highs. Since no new statements about it were issued by Swiss financial authorities, we can assume they must see it as a success.

Recently Bank of Canada became very vocal about its currency. Canadian Dollar has appreciated greatly in last few months, gaining as much as 20% percent in relation to US Dollar. This worries officials, who claim that a stronger currency was a major risk to economic growth, or recovery. Officials stated repeatedly that if this was to happen, Bank of Canada will take steps to soften the effect.

Announcements like that are meant to influence market sentiment. Bank of Canada is hoping to convince market participants that it would be dangerous to keep buying CAD. This would have the desired outcome, without the active involvement of the Bank. Should this measure fall short, however, they will have to physically do something about it. Which might not be as easy as it seems.

Interest rates in Canada are already at historical low of 0.25%. Cutting rates makes currency less attractive for speculative purposes, but in this case there is no real room to maneuver. This means that only viable option is to be actively selling CAD in the open market. There is no doubt BoC would like to avoid this as much as possible, since interventions are expensive and long term consequences hard to predict.