Monday, January 18, 2010

Retail Sales Drags USD Lower

Economic reports slated for release on Friday include December CPI, Empire manufacturing survey, industrial production, capacity utilization and the University of Michigan consumer confidence survey.

USD Bounces Higher, GBP Slumps

Economic growth in the US slowed in the third quarter with GDP downwardly revised to 2.2% from the previous reading of 2.8%. The Q3 GDP deflator was lower at 0.4% from 0.5% previously and PCE prices slipped to 2.6% from 2.7%. Third quarter corporate profits were also downwardly revised to 12.7% compared with 13.4% previously. The key highlight in the data was a strong surge in November existing home sales, which spiked up to 7.4% -- far outpacing estimates for a decline to 2.9% and improving to 6.54 million units. The October home price index improved to 0.6% on a monthly basis and declined by 1.9% on an annualized basis. Meanwhile, the Richmond Fed composite index deteriorated to -4 in December versus a 1.0 reading in the previous month while the services index worsened to -9 from -7.

The calendar for Wednesday includes November PCE, personal income, consumption, the December University of Michigan consumer confidence index, and November new home sales.

China Tightens Policy, JPY Gains

The economic calendar from the US was light, with just the release of the November trade deficit. The US deficit was slightly less than expected at $33.2 billion, versus a revised $32.9 billion from October. The data for the latter part of the week will include on Thursday: December retail sales, weekly jobless claims, November business inventories and on Friday: December real earnings, core CPI, CPI, industrial production, capacity utilization, January NY Fed manufacturing index, and the University of Michigan consumer confidence survey.

The key catalyst in market moves today largely stemmed from an unexpected change in policy from China. The PBOC surprised markets by raising the reserve requirements by 50-basis points overnight, effective January 18th. The move is aimed to cool down China’s economy, preventing it from overheating and preempting inflationary concerns. The move will likely be followed by further action over the coming months, in line with expectations for a global tightening of monetary policy as well – with the RBA the next likely central bank to hike interest rates again.

Dollar Slides vs Major FX

The economic calendar was light today, with the release of the December manufacturing ISM report. The data improved by more than expected, edging up to 55.9 and beating calls for an increase to 54.0 from 53.6 in November. The ISM prices paid component jumped to 61.5 versus 55.0 in the previous month.

The week ahead will see a barrage of reports including November durable goods orders, pending home sales, factory orders, December non-manufacturing ISM, ADP private sector payrolls, weekly jobless claims and the key December jobs report. The non-farm payrolls for December are seen worsening to -20k from -11.0k from a month earlier, while the unemployment rate is expected to edge up slightly to 10.1% from 10.0% from November.

Saturday, January 16, 2010

Canadian Dollar Headed for Parity

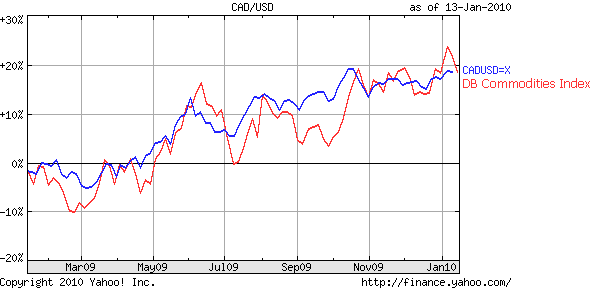

Only a year ago, who could have conceived of such a possibility? At the time, the Canadian Dollar (aka Loonie) was in the doldrums, as a result of the credit crunch and concomitant collapse in commodity prices. In March, however, the Loonie began an extraordinary rally, and finished the year up 16%, almost perfectly offsetting the record decline that it suffered in 2008. As a result, the Loonie is now only pennies away from returning to parity.

The Loonie’s rise can be ascribed to a combination of fundamentals and speculation. On the fundamental side, a surge in the price of oil and other commodities has driven a recovery in the Canadian economy. Summarized one strategist, “The fundamentals in Canada are strong. Sentiment is bullish Canada, and on a relative basis, Canada should do very well with stronger commodity prices and ongoing U.S. economic recovery.” On the other hand, non-commodity exports remain sluggish, such the current account balance is currently in the red.

It’s obvious then that the gap between reality and expectation is being filled by speculation. Despite the fact that both short-term and long-term Canadian interest rates remain low, investors are pouring money into Canadian assets in the hopes that rates will soon rise. This speculation reached a fever pitch in October of 2009, when the Loonie spiked 6% in less than two weeks, following a modest Australian rate hike.

At that point, Canadian Central Bank governor Mark Carney was forced to firmly step in (previously he had effectively remained on the sidelines) by warning investors that he was in no hurry to lift rates, and that “he had ways of cooling the currency.” While analysts credit Carney’s jawboning with effecting a modest decline in the Loonie, it has since resumed its upward march, breaking through the technical barrier of 97.5 CAD/USD yesterday.

In the short-term, sheer momentum will almost surely carry the Loonie through parity with the Dollar. Analysts are divided on the timing, with some suggesting as soon as this month and others suggesting that later in the year is more likely. They should be careful, as there is an exuberance in the forex markets that I havn’t seen since right before Lehman Brothers collapsed- the event that many say signaled the beginning of the forex markets. In other words, investors are surely getting ahead of themselves, since commodities are well off of their 2008 highs, interest rates are down, Canadian economic growth is mediocre, Canada’s fiscal condition is weak, and it is operating a current account deficit.

For this reason, many analysts are already becoming bearish on the Loonie. “The loonie looks potentially more vulnerable on a number of crosses unless we see renewed upside momentum,” expressed a strategist from RBC Capital Markets. But noticed that she framed a continued rise in terms of momentum, rather than fundamentals. That’s tantamount to saying, Unless the Canadian Dollar continues to appreciate, it won’t continue to appreciate. If that’s not a tautology, I don’t know what is! But seriously, she has a point, which is that the Loonie is being driven purely by speculation at this point, in a trade that could soon come crashing down…after it hits parity.

Making Sense of the Yen: Forex Intervention, Debt and Deflation

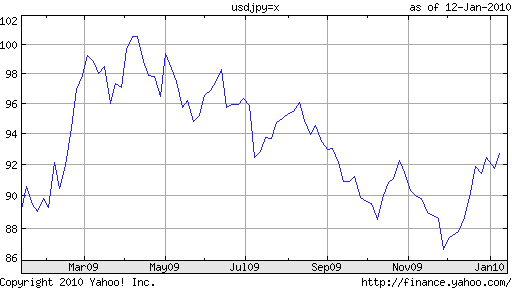

Last week, Hirohisa Fujii resigned as finance minister of Japan. Since Fujii was anoutspoken commentator on the Japanese Yen, the move sent a jolt through forexmarkets. Those who were expecting that his replacement, Deputy Prime Minister Naoto Kan, would be be more consistent than his predecessor were quickly disappointed, as Mr. Kan managed to contradict himself repeatedly within days of assuming his new post.

On January 6, he said it would be “nice” to see the Yen weaken, going so far as to designate 95 Yen/Dollar as the level he had in mind. One day later, he said that the markets should in fact determine the Yen: “If currency levels deviate sharply from the estimates, that could have various effects on the economy.” After he wasrebuked by Prime Minister Yukio Hatoyama, who noted that the government should not talk to reporters about forex, he went on tell US Treasury Secretary that forexlevels should be stable. In short, Japan’s official governmental position on the Yen still remains muddled, and it’s no less clear whether it will – or even should – intervene.

Fortunately, they may not have to. Not only because the Yen still remains more than 5% off of the record highs of November, but also because economic and financial forces are coalescing that could send the Yen downward. Despite a recovery in exports, the Japanese economy remains beleaguered, having most recently contracted to the lowest level since 1991, as part of a “tumble [that] isunprecedented among the biggest economies.” Now that we are into 2010, it can be said officially that Japan has now suffered from the “second lost decade in a row.”

When economic growth collapsed in 1990, Japanese consumers became famously frugal, and the domestic market still hasn’t recovered. Neither has the stock market, for that matter: “The Nikkei is 44.3% below where it stood at the end of 1999. It is 72.9% below its peak near the end of 1989.” The performance of the bond market, meanwhile, has been a mirror image, rallying 78% since 1990.

The resulting decline in real interest rates has combined with economic stagnation to produce a perennial state of deflation. In fact, prices are once again falling, this time by an annualized pace of 2%.

As many economists have been quick to diagnose, the problem lies in a tremendous (perhaps the world’s largest) imbalance between savings and investment, as “Japan still has ¥1,500 trillion ($16.3 trillion) of savings.” It’s not clear how long this can last, however, as Japanese demographic changes tax the nation’s pool of savings. “More than a fifth of Japanese are over 65…The nation’s population began shrinking in 2006 from 127.8 million, and will drop by 3.2 percent in the coming decade.”

This brings me to the final component of Japan’s perfect economic storm: debt. Japan’s gross national debt is projected by the IMF to touch 225% of GDP this year, and 250% as early as 2014. As a result of the aging population, the pool of cash available for lending to the government is shrinking at the same rate as the tax base, which is exerting fiscal pressure on the government from both sides. According to one commentator, “Japan’s fiscal conditions are close to a melting point.” Another frets: “I doubt there is any yield that international capital markets can find acceptable that will not bankrupt the Japanese state.”

What is the government doing about all of this? Frankly, not too much. It is spending money like crazy – exacerbating its fiscal state and pushing it closer to insolvency – in a (vain) attempt to prime the economic pump and avoid deflation from further entrenching. The Central Bank, meanwhile, just announced a new round of quantitative easing, also aimed at fighting deflation. At only 2% of GDP, however, the measures are “pretty tame” and unlikely to accomplish much. Considering that its monetary base has only expanded by 5% this year (compared to 71% in the US), it still has plenty of scope to operate. At the present time, however, it is still reluctant to do so.

Ironically, the aging population phenomenon could end up restoring Japan’s economy to equilibrium. The worse Japan’s fiscal problems become, the sooner it will be forced to simply print money, so as to deflate its debt and avoid default. This will stimulate the economy and put upward pressure on prices (solving two problems), and exert strong downward pressure on the Yen. The way I see it, that’s four birds with one stone!

As for the Yen, then, I would expect it to hover over the near-term, since price stability and a strong credit rating don’t signal immediate catastrophe. No, Japan’s economic problems are more long-term, which means it could be a while before they more clearly manifst themselves.

Chinese RMB Set to Appreciate in 2010

The Chinese Yuan (RMB) spent all of 2009 pegged to the Dollar at 6.83. Since the Dollar depreciated against almost every other currency during that time period, the Yuan has fallen against these currencies, undoing most of its appreciation in 2008. As a result of both international pressure and internal economic conditions, however, the Yuan’s stasis should come to an end soon. The only questions are when, howand to what extent.

In hindsight, the Central Bank (i.e. state economic planners) of China were probably justified in holding the Yuan in 2008. At a time when forex markets (and other capital markets, for that matter) were behaving erratically, the Yuan was a baston of stability. China’s premier, Wen Jiabao, recently boasted, “Keeping the yuan’s value basically steady is our contribution to the international community at a time when the world’s major currencies have been devalued.” In fact, there is evidence that the Central Bank went against market forces in the opposite direction during the height of the credit crisis, and successfully prevented the Yuan from depreciating, thus proving that a currency peg can work both ways. The result was price stability, and a boost to exporters that had been damaged by the falloff in foreign demand for Chinese goods.

With the global economy emerging from recession, the argument for maintaining the peg is becoming less tenable. China’s economy, itself, grew at an impressive 8.5% in 2009, and is forecast to grow even faster in 2010, by 9.5%. Thanks to a surge in bank lending and the government’s massive economic stimulus program, inflation is also ticking up. It has been approximated at 2.5%, but is contradicted by spikes of 50%+ in the prices of certain staple goods, and certainly doesn’t take into account the rise in asset prices. China’s benchmark stock market index surged 90% in 2009, and property prices increased by 30% in some areas.

The dual concerns, of course, are that the money supply is expanding too fast and that bubbles are forming in certain asset markets. The weak RMB is certainly not helping either. Thanks to relaxed capital market controls and expectations of further appreciation, speculative “hot money” is once again pouring into China. Holding down the Yuan in the face of such pressure is becoming prohibitivel expensive: “China’s foreign-exchange reserves climbed 17 percent in the first nine months of 2009 to $2.27 trillion, the world’s largest holdings.” Some of the demand is naturally beingtempered by bubble concerns, but the trend is still money coming into China.

There is also the argument, much mooted in economics circles, that an appreciation of the RMB would be good for the Chinese economy. Because of a perennially weak currency, its economy has become to addicted to exports to drive growth. “As a report from research firm Euromonitor International notes, in U.S. dollar terms,China’s consumer market lags those of the U.S., Japan and much of Europe, with private consumption just over one third of GDP in 2008.” This is probably a product of social and cultural forces, which still emphasize saving. Skeptics of the usefulnes of RMB appreciation point out that rebalancing the Chinese economy would start with changing the culture of saving, but a stronger currency would certainly provide a powerful incentive. Not to mention that a more valuable RMB would give Chinese companies more leverage in consummating outbound corporate M&A deals and natural resource acquisitions that they have been so keen on in recent years.

On the other side of the debate are skeptics of a different sort- those that think RMB appreciation is justified by forward-looking macroeconomic fundamentals. Some fear hyperinflation of the sort that China faced in 2007 and was only brought under control by the global economic recession and concomitant decline in resource prices. “Franklin Allen, a professor of finance at Wharton [University of Pennsylvania], estimates the likelihood of inflation reaching between 10% and 20% to be around one in five.” Any inflation beyond what is experienced in other economies would have to be reflected in the RMB. In a hyperinflation scenario, the Central Bank might even have to deliberately depreciate the currency.

Then there are the skeptics that forecast an economic crash in China. James Chanos, a wealthy hedge fund manager is leading this chorus, “warning that China’s hyperstimulated economy is headed for a crash, rather than the sustained boom that most economists predict. Its surging real estate sector, buoyed by a flood of speculative capital, looks like “Dubai times 1,000 — or worse.’ ”

While this view is gaining some traction, it is still relegated to the minority. Investors and economists are now operating under the firm assumption that China will allow the RMB to resume its appreciation soon. As for when, it could be any day, though probably not for a few months still. As for the questions of how and to what extent, some economists have argued for a one-off appreciation (10% has been suggested)in order to discourage future inflows of speculative capital. Most analysts, though, expect the rise to be gradual. Futures prices currently reflect a 3% rise over the next year, and the consensus among economists is similar. It also depends on how the Dollar performs over the near-term: “If better-than-expected growth in the U.S. helps the greenback recover this year…That would take some of the pressure off Chinese policy makers.”

CANCEL\REPLACE ORDERS IN FOREX

potential loss, so you cancel your Stop Order at 1.390 and replace it to 1.410 where you got in. You are now in a trade with no risk. As the market moves further north in your direction, you now want to lock in more profit. You cancel your 1.410 Stop Loss Order and replace it with a new 1.440 Stop Loss Order. You now have locked in 30 Pips in profit. You are in an all-win, no-risk trade. You keep canceling and replacing your Stop until you are finally stopped out.

STOP ORDERS IN FOREX

The majority of Stop Orders are used as protective Stop Loss Orders. It is the order you place with your entry order to insure an exit when the market goes against you. A good trader never trades without a protective Stop Loss Order. They are orders executed to get you out of the market when your trade has gone against you.

LIMIT ORDERS IN FOREX

When you sell above the market, it is a Limit Order. When you buy below the market, it is a Limit Order. A limit order will be executed when the market trades through it. Seventy to ninety percent (70% to 90%) of the time, if the market is trading at your Limit Order it will be executed. The market must trade through you specified Limit Order number to guarantee a fill. The computer will notify you within seconds of your fill. You do not have to call your broker to see if you have been filled.

MARKET ORDERS IN FOREX

Trading is an auction where there are buyers (bidders) and sellers (offerers). The bid is the "buy" and the "ask", or offer is the sell. Slippage is defined as: when a trade is executed between a buyer and seller and the resulting buy or sell transaction is different than the price you saw just prior to order execution. With Market Orders you will lose on average one to six pips, if not more, due to slippage. Market Orders are rarely filled at the exact price you are expecting. We Recommend caution when entering or exiting with a Market Order.

ORDERS

Remember: all good carpenters carry a toolbox. The sharper his tools and the more skilled he is at using them, the more effective he is. The sharper you are as a trader the more effective and profitable you will become.

MARGIN ACCOUNTS

All orders must be placed through a broker. To trade stocks you will need a stockbroker and to trade currencies you will need a Forex currency broker. Most brokerage firms have different margin requirements. You need to ask them their margin requirements to trade stocks and currencies.

A margin account is nothing more than a performance bond. All traders need a margin account to trade. When you gain profits, they place your profits into your margin account the same day you profited. When you lose profits, they need an account to take out the losses you incurred that day. All accounts are settled daily.

A very important part of trading is, taking out some of your winnings or profits. When the time comes to take out your personal gains from your margin account, all you need to do is contact your broker and ask them to send you your requested dollar amount, and they will send you a check. They can also wire transfer your money.

EXECUTION QUALITY:

Confirmations of trades are immediate and the Internet trader has only to print a copy of the computer screen for a written record of all trading activities. Many individuals feel these features of Internet trading make it safer that using the telephone to trade. Respected firms such as Charles Schwab, Quick & Reilly and T.D. Waterhouse offer Internet trading. They would not risk their reputations by offering Internet service if it were not

reliable and safe. In the event of a temporary technical computer problem with the broker’s ordering system, the trader can telephone the broker 24 hours a day to immediately get in or out of a trade.

Internet brokers’ computer systems are protected by “firewalls” to keep account information from prying eyes. Account security is a broker’s highest concern. They have taken multiple steps to eliminate any risk associated with transacting on the Internet.

A FOREX Internet trader does not have to speak with a broker by telephone. The elimination of the middleman (broker salesman) lowers expenses and makes the process of entering an order faster and has eliminated the possibility for misunderstanding.

LEVERAGE

Brokers have differing margin account regulations, with many requiring a $1,000 deposit to “day-trade” a currency lot. Day-trading is entering and exiting positions during the same trading day. For longer-term positions, many require a $2,000 per lot deposit. In comparison to trading in stocks and other markets, which may require a 50% margin account, FOREX speculators excellent leverage of 1% to 2% of the $100,000 lot value. The trader can control each lot for I to 2 cents on the dollar

TWO WAY MARKET

FOREX trading permits profit taking from both rising and falling currency values in relation to the dollar. In every currency trading transaction, one of the sides of the pair is always gaining and the other side is losing.

FOREX ACCESS

Since no money is left on the market “table,” this is what is referred to as a “Zero Sum Game” or “Zero-Sum Gain.” Providing the trader picks the right side, money can always be made.

FOREX Traders Mission And Goal

2. The trader must commit himself to continued education and learn as much as he can about technical analysis and the psychology of successful trading. He must use logic, and not his emotions, in trading. The trader must learn to trade in control, not out of control!

3. The trader must map out a sound plan of equity management to insure a return on his investment. A successful plan is to trade no more than 20% of a margin account and risk no more than 5 to 10% of that account on any single trade

Thursday, January 7, 2010

Toronto Stocks Finish Slightly Higher, Gain More Than 23% In 2009

Bay Street stocks finished in the green on Friday amid light volume, posting its seventh gain in the last eight sessions of 2010. Consumer staples and healthcare stocks drove the market into positive territory.

The S&P/TSX Composite Index climbed 28.65 points or 0.24% to settle at 11,746.11. The index rose 2,758.41 points or 23.5% on the year.

Consumer staples stocks rose 1.4%. Saputo (SAP.TO) rose 1.9%, Jean Contu (PJC.A.TO) gained 1.8% and Shopper's Choice (SC.TO) added 1.7%.

Healthcare stocks posted a 1.2% gain. MDS (MDS.TO) rose 3.4% on the session to lead the sector higher.

Black Diamond Income Fund (BDI.UN.TO) rallied 7.3% after being upgraded the stock to Strong Buy from Outperform at Raymond James.

Endeavor Silver (EDR.TO) fell 2.3% after brokerage Haywood initiated coverage of the stock with a Sector Perform rating.

Crocotta Energy (CTA.TO) gained 5% after it said it would be selling various non-core properties for C$33 million and announced it had signed a new bank credit facility for C$58 million.

Liquidation World (LQW.TO) declined 4.1% after the company reported a net loss of C$3.39 million, compared with a loss of C$2.71 million last year.

In economic news, the U.S. Labor Department said that jobless claims fell to 432,000 from the previous week's revised figure of 454,000. The decrease came as a surprise to economists, who had expected jobless claims to edge up to 460,000 from the 452,000 originally reported for the previous week.

There was no major economic data planned for Thursday in Canada. Next week's agenda will include the industrial product price index on Tuesday.

Dollar Ends Topsy Turvy Year With Mixed Showing

The dollar spent the last day of a tumultuous year in characteristic fashion, with an uneven performance that saw it extend recent gains against the yen and turn sharply lower versus the sterling.

Versus the euro, the dollar held most of its recent gains, as traders looked to the new year for further signs that the economy is on the road to recovery.

The dollar spent most of 2009 on the defensive against other majors, particularly the euro and yen. However, a December rally has allowed the dollar to pare a portion of its yearly losses.

Recent speculation that the Federal Reserve may soon unwind unprecedented support measures taken during the worst of the economic crisis has given the dollar a boost of late.

The buck jumped above 93 on Thursday, hitting its highest level since early September. Just a month ago, the dollar was at a 1995 low of 84.80, but has fought back amid indications that Japanese officials are prepared to intervene to prevent the yen from rising any further.

The dollar held its ground versus the euro, staying near 1.4340. Last week, the dollar hit a 3 1/2 month high near 1.4200, the culmination of a move away from November's yearly low near 1.5100.

Against the sterling, the dollar plunged to 1.6236 before finding its footing in mid-day action. With the loss, the dollar pulled back from a 2-month high of 1.5831 set earlier this week.

In the final piece of economic data for the year, initial jobless claims unexpectedly fell to their lowest level in well over a year last week, providing further evidence of stabilization in the beaten down jobs market.

The Labor Department report showed Thursday that jobless claims fell to 432,000 from the previous week's revised figure of 454,000. The decrease came as a surprise to economists, who had expected jobless claims to edge up to 460,000 from the 452,000 originally reported for the previous week.

Stocks End Notably Lower Despite Improved Jobs Report - U.S. Commentary

(RTTNews) - Stocks saw sharp losses on the last trading day of 2009 on Thursday, as traders largely looked past improved jobs data and cashed in on the year's strong gains. The major averages all ended the session in negative territory by notable margins, moving further off of the yearly highs set earlier in the week.

The downturn in the markets came even though the Labor Department reported that jobless claims fell to 432,000 in the week ended December 26th from the previous week's revised figure of 454,000.

The decrease came as a surprise to economists, who had expected jobless claims to edge up to 460,000 from the 452,000 originally reported for the previous week.

With the drop, jobless claims extended the downward trend seen over the past few months, falling to their lowest level since coming at 413,000 in the week ended July 19th, 2008.

On the corporate front, Marvel Entertainment Inc. (MVL) said that its shareholders have approved the company's merger with Walt Disney Co. (DIS), under which Marvel will become Disney's wholly-owned subsidiary.

The company anticipates the deal, valued at about $4.3 billion based on Disney's closing price on Wednesday, to be completed after the close of trading today.

The major averages accelerated to the downside in the latter part of the trading day, ending the day firmly in negative territory. The Dow lost 120.46 points or 1.1 percent to close at 10,428.05, the Nasdaq fell by 22.13 points or 1 percent to 2,269.15 and the S&P 500 declined by 11.32 points or 1 percent to 1,115.10.

With today's drop, the major averages closed lower for the holiday-shortened week, with the S&P 500 and the Dow falling by 1 percent and 0.9 percent, respectively, while the Nasdaq fell by 0.7 percent.

Nonetheless, the major averages saw substantial gains for the year, as they rallied from their March lows. The Nasdaq jumped by 43.9 percent, while the S&P 500 and the Dow shot up by somewhat more modest margins, registering yearly gains of 23.4 percent and 18.8 percent, respectively.

Sector News

Trucking stocks were some of the day's worst performers, dragging down the Dow Jones Trucking Index down by 3.2 percent. With the pullback, the index moved further off the fifteen month closing high set on Tuesday.

The sector was hurt by shares of YRC Worldwide (YRCW), as traders expressed concerns regarding the company's viability even though it completed a critical debt-for-equity exchange that staved off bankruptcy. Shares of YRC saw a loss of 15.2 percent.

Commercial real estate stocks also ended the day markedly lower, as reflected by the 1.9 percent drop in the Morgan Stanley REIT Index. The loss dragged the index further away from the nearly fifteen month closing high it set on Monday.

Healthcare, utilities, defense and software stocks were also under pressure, while some gold stocks were able to buck the late-session sell-off, with the NYSE Arca Gold Bugs Index posting a gain of 0.4 percent.

Dow Components

Hewlett Packard (HPQ) was the worst Dow's worst laggard, posting a loss of 2.7 percent on the day. With the pullback, shares pulled back well off of the more than two-year closing high set on Wednesday.

Microsoft (MSFT) also fell by a notable margin, registering a loss of 1.6 percent. The day's selling pressure pulled shares of the software giant further away from Tuesday's twenty-month closing high.

Caterpillar (CAT), Pfizer (PFE) and Wal-Mart (WMT) also fell, along with a vast majority of the other blue chip stocks, contributing to the triple digit pullback by the Dow. Meanwhile, JP Morgan Chase (JPM) was the only Dow component to eke out a gain, climbing by 0.3 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region closed higher amid limited trading on Thursday. India's BSE 30 Index gained 0.7 percent, while China's Shanghai Composite Index rose by 1.6 percent. Japanese markets were closed on the day.

The European markets also saw modest strength on Thursday, although several markets in the region were closed on the day. The U.K.'s FTSE 100 Index closed up 0.3 percent in a holiday-shortened session, while the French CAC 40 Index closed just above the unchanged line.

In the bond markets, treasuries sold off following this morning's upbeat jobs report. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, closed at 3.843 percent, posting a gain of 5.9 basis points.

Looking Ahead

In the first trading week of 2010, stocks are likely to take cues from data on manufacturing, pending home sales and the all-important monthly jobs report for December of 2009.